TradingDiary Pro has an advanced tax reporting system with exchange rate download support from central banks. This means you can create your tax report in different currency than the base currency. Currently the following currencies are supported: EUR, CAD, AUD, CZK, HUF, PLN.

This does not mean that the software is not able create the tax report in any currency but the exchange download is only supported in the above mentioned currencies.

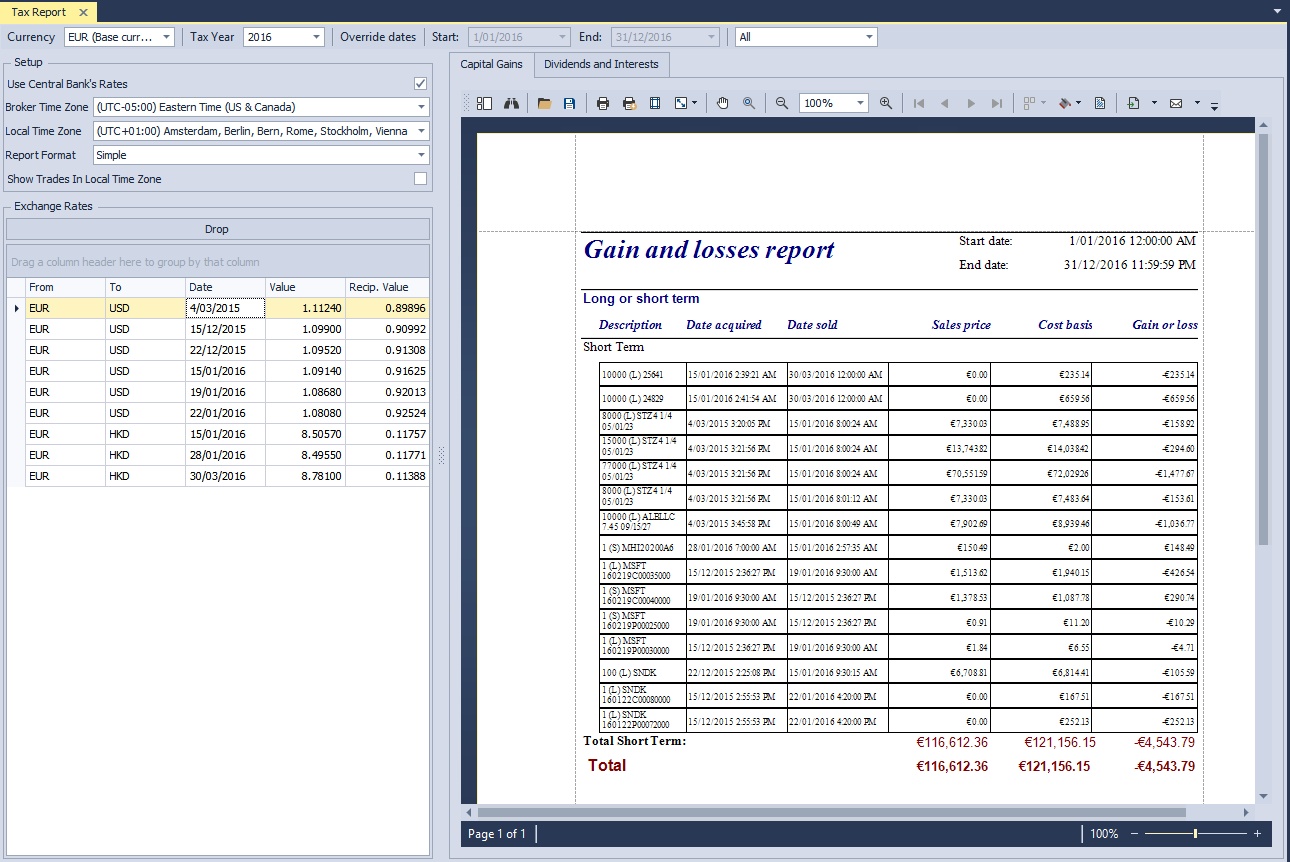

In the top tools strip you can set the followings:

oCurrency. You can choose the base currency or from the followings: EUR, CAD, AUD, CZK, HUF, PLN.

oTax Year. The software checks the positions in the database and populate the list according to them. For AUD the software follows the Australian tax year.

oOverride dates. You can override the default tax year start and end dates.

oFilter drop down. You can create your tax report for a special set of positions defined by a filter.

Setup

oUse Central Bank's rates. Checking this option the software will downloads exchange rates from our servers (which is always based on the central bank rates) and uses them instead of the previously set rates. For example Interactive Brokers provides interest rates in the flex statements.

oBroker Time Zone - you can set the broker time zone here.

oLocal Time Zone - you can set your local time zone here.

oReport Format. Report format of the capital gains report. There are two options simple and detailed. Please read below the description of each format.

oShow Trades In Local Time Zone. By checking this option the software adjusts the date and time according to the time difference between the broker and local time zone.

Description of the fields of the Simple format

(a) Desc of property - description of the property in the following format: Quantity (L or S) Ticker.

(b) Date acquired - the date when the property is acquired. If the position is a short position the exit date will be the acquiring date.

(c) Date sold - the date when the property is sold. If the position is a short position the entry date will be the sold date.

(d) Sales price - the amount of the sale.

The calculation algorithm for long a position is: Quantity * Multiplier * Exit Price * Exit Exchange Rate

The calculation algorithm for short a position is: Quantity * Multiplier * Entry Price * Entry Exchange Rate

(e) Cost or other basis

The calculation algorithm for long position is: Commissions + Quantity * Multiplier * Entry Price * Entry Exchange Rate

The calculation algorithm for short position is: Commissions + Quantity * Multiplier * Exit Price * Exit Exchange Rate

(f) Gain or Loss. The calculation algorithm is: Cost or other basis - Sales price

Description of fields of the Detailed format

Long or Short Term - Long term: holding period is more than a year, short term: holding period is less than a year.

Description with LS - Format: Description of the instrument (L or S)

Ticker - Ticker of the instrument

Exchange - NYMEX, ISLAND etc.

Quantity - Quantity/Shares/Contracts

Date acquired - the date when the property is acquired. If the position is a short position the exit date will be the acquiring date.

Date sold - the date when the property is sold. If the position is a short position the entry date will be the sold date.

Sales price - the amount of the sale.

The calculation algorithm for long a position is: Quantity * Multiplier * Exit Price * Exit Exchange Rate

The calculation algorithm for short a position is: Quantity * Multiplier * Entry Price * Entry Exchange Rate

Entry Comm. - Entry Commission

Cost or other basis

The calculation algorithm for long position is: Commissions + Quantity * Multiplier * Entry Price * Entry Exchange Rate

The calculation algorithm for short position is: Commissions + Quantity * Multiplier * Exit Price * Exit Exchange Rate

Exit Comm. - Exit commission

Gain or Loss. The calculation algorithm is: Cost or other basis - Sales price

Gain or Loss Without Commission: The calculation algorithm: Cost or other basis - Sales price - Commissions